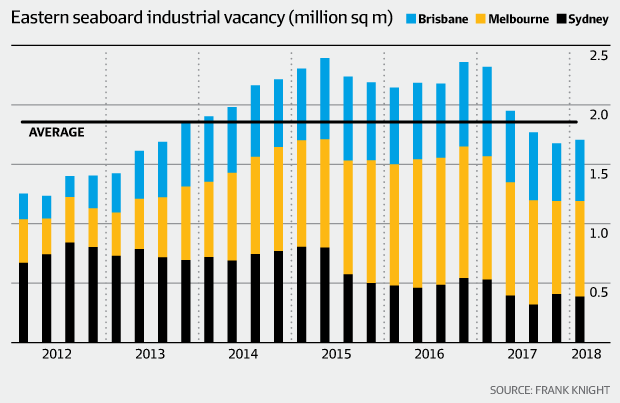

The amount of vacant industrial property space has fallen 26 per cent in the east coast markets over the last year as retailers demand more space in warehouses and logistics facilities.

The total industrial vacancy across the major markets of Sydney, Melbourne and Brisbane now sits at 1.7 million square metres.

That is a sharp drop of 580,660sq m over the past 12 months, according to Knight Frank figures. Total vacancy is 26 per cent down.

In the last quarter vacancy ticked up by 1.6 per cent, but not enough to outweigh the broader squeeze in the sector over the full year.

The Sydney market remains close to its cyclical low of mid-2017, with just 384,000sq m of space available.

In Melbourne and Brisbane vacancy stabilised over the past quarter at levels just above the four-year lows of October 2017, at 799,000sq m and 515,000sq m respectively.

The annual take-up for vacant industrial space was more than 1.88 million sq m in 2017; well above the annual average of 1.46 million sqm.

Robust demand

“The steep drop in vacancy over the past year reflects robust demand for space from retail-driven logistics and third-party logistics providers,” said Knight Frank’s head of industrial for Australia, Tim Armstrong.

“Tenants continue to seek to consolidate and improve the quality of their accommodation, with 66 per cent of take-up for the quarter in prime accommodation."

Melbourne experienced the strongest take-up over the past year, up by 27 per cent to 812,000sq m. The western precinct was the most dominant for industrial activity.

Brisbane had the largest take-up increase of 51 per cent to 488,000sq m for 2017. That surge was achieved even though last quarter slowed as decisions were deferred due to the November state election.

In Sydney, activity is limited by the amount of space available. The 2017 take-up was 23 per cent below 2016 levels.

“Continued strong demand for modern facilities in these major industrial markets reflects structural change in the sources and quantum of demand, with supply not keeping up at present,” said research head Ben Burston.

There level of speculative space – projects without pre-commitment – under construction is below average across all markets except Melbourne.

“We can expect conditions to remain tight over the next 12 months. Sydney, in particular, needs to see more speculative supply to redress the current imbalance,” Mr Burston said

by Jessica Hammoud in Latest News

Archived Posts

- April 2025 (1)

- February 2025 (4)

- December 2024 (1)

- November 2024 (3)

- October 2024 (1)

- September 2024 (1)

- August 2024 (1)

- July 2024 (1)

- February 2024 (2)

- November 2023 (3)

- July 2023 (3)

- March 2023 (1)

- September 2022 (1)

- June 2022 (3)

- March 2022 (1)

- February 2022 (6)

- May 2021 (2)

- March 2021 (1)

- February 2021 (1)

- December 2020 (1)

- November 2020 (1)

- October 2020 (1)

- September 2020 (1)

- August 2020 (1)

- July 2020 (4)

- February 2020 (1)

- December 2019 (3)

- August 2019 (1)

- July 2019 (1)

- June 2019 (1)

- March 2019 (4)

- February 2019 (3)

- December 2018 (3)

- November 2018 (3)

- October 2018 (3)

- September 2018 (3)

- August 2018 (3)

- July 2018 (3)

- June 2018 (3)

- May 2018 (8)

- April 2018 (3)

- March 2018 (2)

- February 2018 (3)

- December 2017 (3)

- November 2017 (4)

- October 2017 (5)

- August 2017 (3)

- July 2017 (3)

- June 2017 (3)

- May 2017 (3)

- April 2017 (10)

- March 2017 (3)

- February 2017 (4)

- December 2016 (5)

- November 2016 (10)

- October 2016 (6)

- September 2016 (6)

- August 2016 (3)

- July 2016 (3)

- June 2016 (2)

- May 2011 (1)